The Path To Finding Better Guides

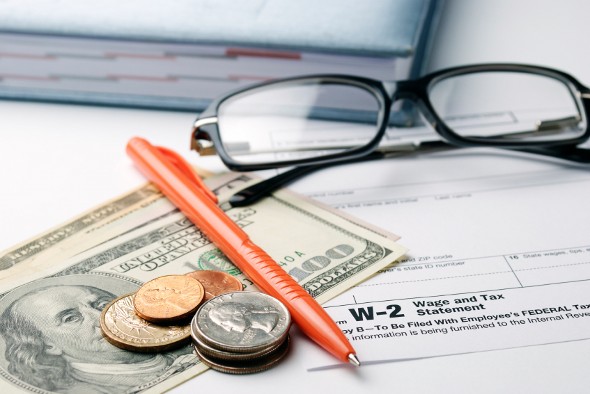

The Reasons Behind the Importance of the W-2 Form

The Reasons Behind the Importance of the W-2 Form

W-2 forms are crucial part on the tax preparation of people if they will report on the wages which are paid and the taxes which are withheld by the employer. One considered advantage with tax-related forms is that there’s entirely no need to fill out a W-2 form. Yo simply just need to get it and use it.

An essential thing that you should know first is that you will not be the only one who the employer will prepare a W-2. The IRS, Social Security Administration and you will be able to get a copy, which makes it unwise of thinking about under-reporting your wage or perhaps to over-report your tax. It’s very crucial that you know that you would expect a W2 form when you are an employee and you have obtained a certain amount or perhaps had any amount withheld. If you earn money by being an independent contractor, you will get the form of 1099 instead than receiving a W-2 from the employer as long as you are able to make more than the certain amount requirement.

After you have received your W-2 form which the employer needs you to send, you will mostly get multiple copies. This is done in order for you to keep one of the records and to be able to include a copy with your federal tax return as well as your city, state and local tax returns. In case that you have not obtained your W-2 on time, the IRS comes with certain guidelines regarding the things that you can do.

It is very important that you also do reviews on your W-2 form so you could ensure that the information is correct. In case your name is misspelled or the Social Security number provided is wrong, the IRS will have problems on matching the records which you paid and earned and to what you report them. This is going to delay the process of return and will also trigger an audit.

You may be aware on some cases that people who are self-employed needs to make an estimated tax payment for the entire year and assume that there’s need to pay the taxes. This actually is not the case because employees are required to make regular tax payments throughout the year. This would not be the case if the employer withholds the taxes from your paycheck. They actually are withheld and then will be sent to the IRS.

If you prepare your taxes, your W-2 summarizes on how much had been withheld to income taxes, Social Security as well as on Medicare. If you will calculate on the total tax due well for the year, you actually could easily deduct how much you paid already for the IRS and owing a little more with the taxes or get a refund for over-payments if there are any.